Understanding the future of Humira Biosimilar

|

| Humira Biosimilar |

Biosimilars are touted as the future of innovative biologic medicines, offering more affordable treatment options for patients worldwide. However, with the impending patent expiry of blockbuster drugs like Humira, there are still many unanswered questions about how the biosimilar market will evolve.

What are biosimilars?

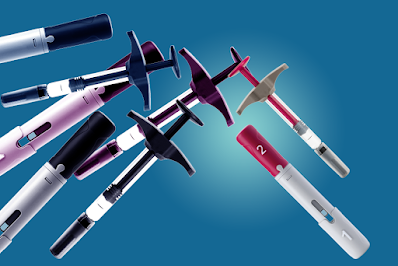

Biosimilars are biologic medicines that are developed to be similar to an

existing approved biologic drug, known as the reference product. They are

engineered to be highly similar to the original biologic in terms of quality

characteristics, biological activity, safety and efficacy. However, biosimilars

are not generic copies of biologics. Developing a biosimilar is more

challenging than a generic small molecule drug due to the complexity of

biologics which are produced through living systems. Stringent regulatory

requirements need to be fulfilled to demonstrate biosimilarity.

The first Humira biosimilar

Humira (adalimumab) developed by AbbVie is the highest selling drug globally.

It generated over $20 billion in annual sales mainly treating autoimmune

conditions like rheumatoid arthritis. Its patent expires in 2023 in the US and

EU markets. However, the first Humira

Biosimilar, Idacio, developed by Samsung Bioepis was approved by the

European Medicines Agency (EMA) in August 2017. Other biosimilars are also

under review. The approval of Idacio has set an important precedent and

demonstrated the regulatory pathway for the approval of additional Humira

biosimilars in key markets.

Impact on pricing and patient access

The introduction of Humira biosimilars is anticipated to significantly reduced

drug costs and expand access to treatment. Experts estimate biosimilars could

lower Humira's list price by 15-30%. This could translate to annual savings of

$1-2 billion for the US healthcare system alone. Lower costs would allow more

patients to initiate and maintain Humira therapy. For example, in Denmark where

three Humira biosimilars are available, the uptake has increased to over 60% of

all adalimumab prescriptions due to lower prices. Wider availability of

biosimilars is expected to have a similar positive impact globally.

Challenges to achieve price reductions

However, there are concerns that not all the potential savings from biosimilars

may be realised. Pharmaceutical companies use a variety of strategies to retain

market share such as patient loyalty programs, copay cards and authorised

generics sold at only slightly lower prices. Manufacturers of Humira have

already launched these programs worth billions indicating they will face

biosimilars aggressively. Regulatory issues like interchangeability status and

restrictive formulary placement can reduce uptake and competition as well.

Ongoing litigation between manufacturers may further delay biosimilar approvals

and benefits for years. Overcoming these hurdles will be important for maximising

the affordability impact of biosimilars.

Prospects for Humira biosimilars in the US

The US represents over 50% of Humira's global sales currently. But biosimilar

approvals have come slowly in the US compared to Europe due to the complexity

of the regulatory pathway. The first Humira biosimilar, Amjevita, was only

approved in September 2016. Several others are under review but face patent

litigation delays. It is anticipated wider availability of Humira biosimilars

starting 2023 could lower the drug's US sales by $2-4 billion per year.

However, the barriers highlighted previously may dampen uptake and competitive

pressure on prices in the short term compared to a quicker uptake seen in some

European markets. Over time, as more are approved and market dynamics evolve

the full generic-like price reductions may be realised in the US as well.

Manufacturer strategies for the biosimilar era

Facing biosimilar competition, manufacturers are pursuing strategies to

transition patients to newer product lines and indications. AbbVie is

developing next-generation Humira formulations like adalimumab-adaz to extend

market exclusivity. They are also investigating Humira for additional

autoimmune and cancer indications. More approved uses would make switching to

biosimilars logistically complex. In 2018, Humira's sales grew 16%

year-over-year indicating these strategies are maintaining growth. As the

adalimumab biosimilar market matures, an increasing proportion of global Humira

sales will come from new territories, formulations and expanded label

approvals. This ensures AbbVie sustains Humira's revenues despite impending

patent expiry and biosimilar erosion.

Get More Insights on Humira Biosimilar

Comments

Post a Comment